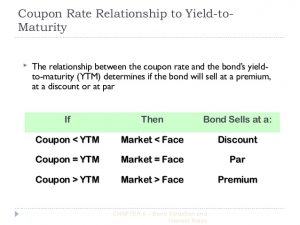

42 relationship between coupon rate and ytm

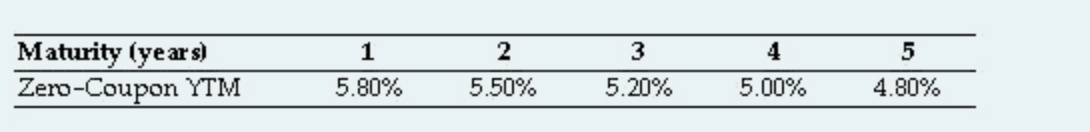

Quantitative problem chapter 3 | Accounting homework help A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for $871.65. Compute your rate of return if you sell the bond next year for $880.10. 10. You have paid $980.30 for an 8% coupon bond with a face value of $1,000 that mature in five years. You plan on holding the bond for one year. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.995% yield. 10 Years vs 2 Years bond spread is -4.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

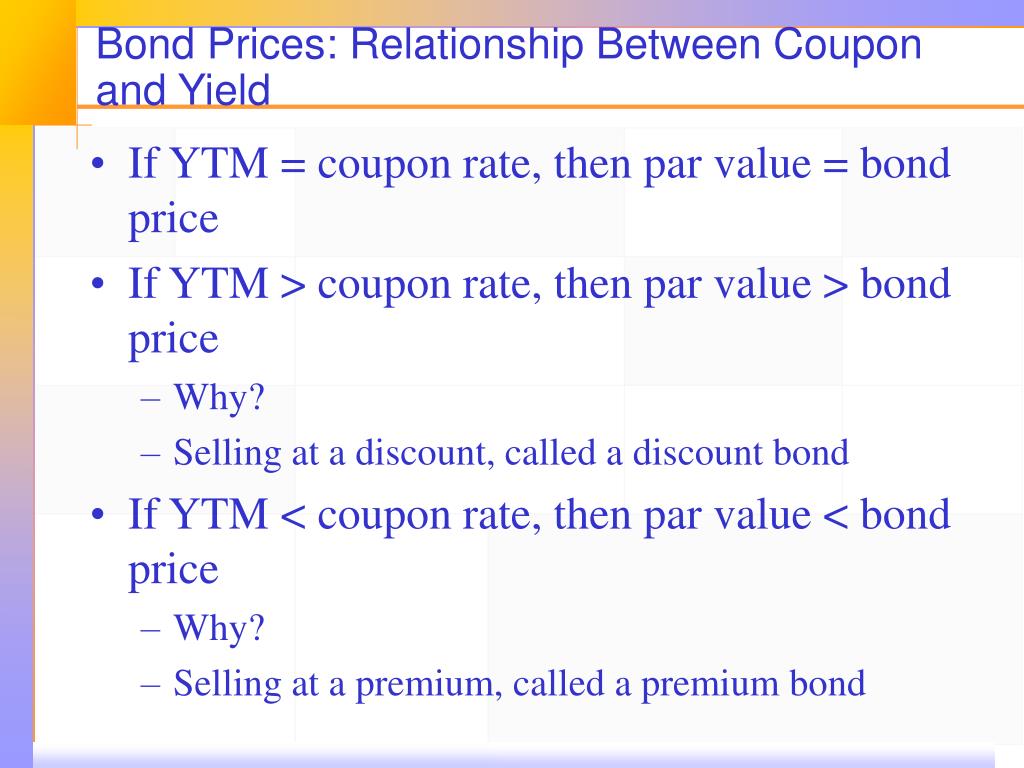

which of the following bonds is trading at par If the YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par". If the rate of interest currently is 8% the value of the bond is Rs. The following guide highlights the key points to consider when planning an open market bond repurchase transaction.

Relationship between coupon rate and ytm

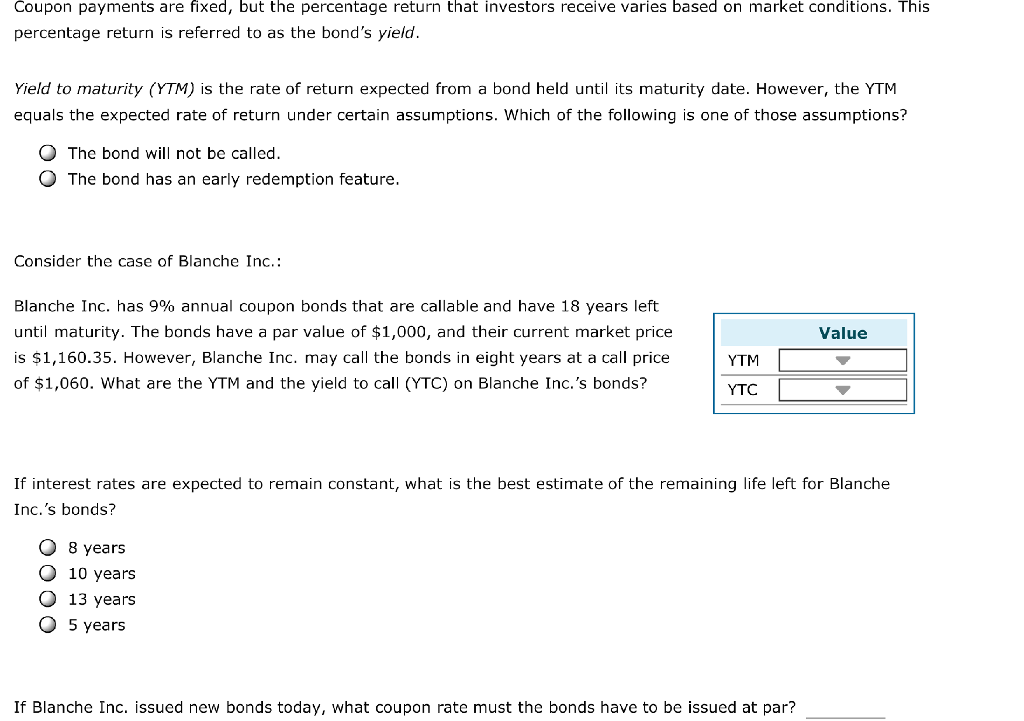

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.415% yield.. 10 Years vs 2 Years bond spread is 99.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%. Limited Duration - Institutional Class - Guggenheim Investments If there is no relationship between two variables, the correlation coefficient is 0. If there is a perfect relationship, the correlation is 1. And if there is a perfect inverse relationship, the correlation is -1. Duration is a measure of interest-rate sensitivity of a fixed-income security based on an interest rate change of 1% or 100 basis ... Bond Valuation - brainmass.com Yield to Call (YTC) and Yield to Maturity (YTM) of bonds Southern Bell has issued $1000 par, 43/8% coupon bonds that mature in 6 years. The coupons on these bonds are paid semiannually. These bonds are currently trading at a price of $853.75. The bonds are callable in 2 years at a call price of $1000. a.

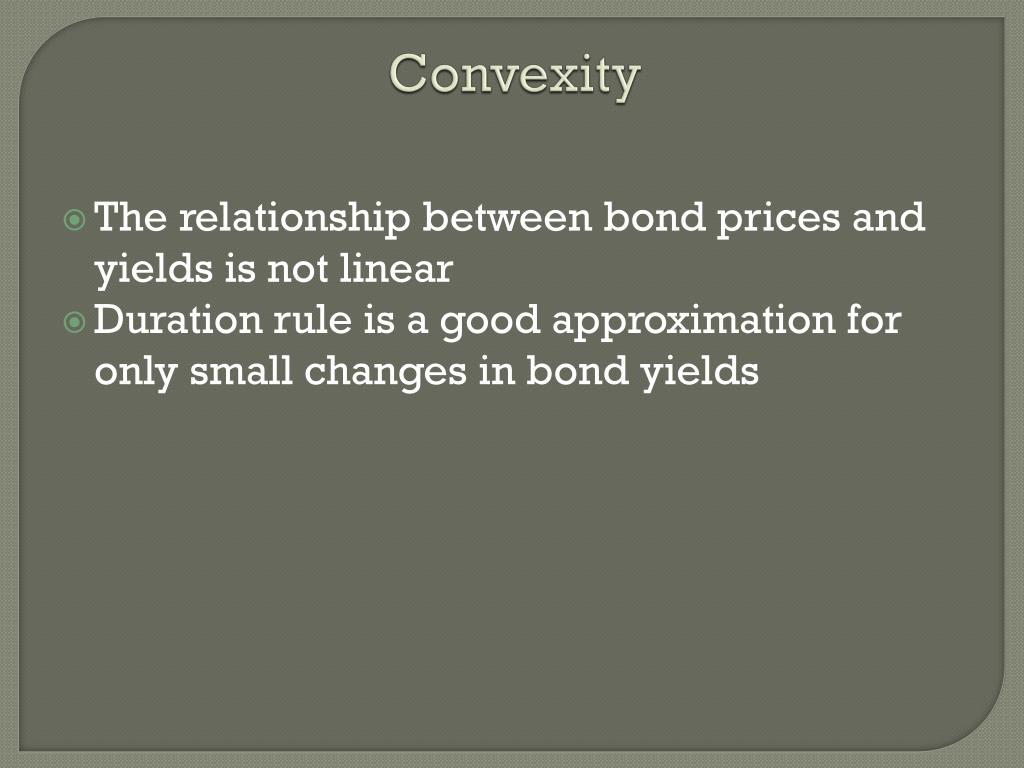

Relationship between coupon rate and ytm. Bond Convexity | Convexity Formula, Properties & Examples - Video ... A bond that yields 5% may be an attractive investment when the risk-free rate of yield is 2% but is much less so if the rate rises to 4%. Demand for the bond will drop and its price will fall.... Spread Yield Curve Search: Yield Curve Spread. 1 With the recent turmoil among financial markets, the yield spread between the Treasury 10-year and 1-year notes stands at 14 basis points The slope of the yield curve has proven to be a good forecaster of economic growth The yield curve is a graph that plots the yield of various bonds a g ainst their term-to- maturity Colorado Office It shows the yield an investor ... Best Investment Banking Training Institute In Mumbai - DataTrained Interest Rate and Bond Price Relation with Example; Current Yield; Yield and Bond Price; Difference between Coupon and Yield; Yield to Maturity (YTM) Difference between Coupon and Yield; Accrued Interest; Dirty Price & Clean Price; ... Get a birds-eye view of the relationship between the three financial statements and how accounting is going to ... Interest Rates and the Cost of Debt - brainmass.com Estimating YTC and YTM Company considering bonds for sale that have a $1000 par value and will mature in 16 years. The coupon rate on the bonds is 5% paid annually and are currently selling for $987 each. The bonds are called protected for the next 4 years and after this period they are callable at 105. 1) What is the YTM on these bonds? 2) If the

Finance Archive | July 07, 2022 | Chegg.com The tax rate is 21%. The project 3 answers A firm's capital structure for its common stock, preferred stock and debt (bond) is 20%, 40% and 40% respectively. The firm's beta is 1. The risk free rate is 3% and the market risk premium is 4%. The 1 answer A stock's price per share is $30. A shareholder invests $5,000 in the stock. ProShares TBT ETF: A Textbook Macro Trade For Difficult Times Assuming that there is a 10% chance of running to $111.76/share, a 10% chance of a decline by as much as 20% at a stop, a 40% chance of surpassing $50/share, and another 40% chance it passes... Coupon Meter Difference between YTM and Coupon Rates The formula for calculating YTM is as follows: YTM = [ (C/P) (1/n)]- [ (1+ (C/P))^ (-nYTM)] in which C equals annual coupon payments, P equals the price of the bond, n equals a number of compounding periods per year, and t equals a number of years until maturity. Hotel Free Coupons The event ... 10% off - 60% off InnovaToys Coupons, Coupon Codes, Promo Codes July 2022 Don't miss this great discount from InnovaToys: Get 25% Off Sitewide. No promo code or voucher code required. No promo code or voucher code required. Shop Now and Save with InnovaToys discount codes & vouchers.

Yield to Maturity vs. Coupon Rate: What's the Difference? Easy Travel Coupons July 10, 2022. Macy's Coupons - 25% OFF in July 2022 - CNN Save 25% with Macy's Star Passes if you spend $499 on any day you choose. If you pay between $500 and $1199, you'll get free shipping plus a special birthday offer just for you. On $1200+ orders, you'll receive 5% back in the form of rewards such as surprise savings, priority customer ... Moody's Seasoned Aaa Corporate Bond Yield Relative to Yield on 10-Year ... Graph and download economic data for Moody's Seasoned Aaa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity (AAA10Y) from 1983-01-03 to 2022-07-07 about AAA, spread, 10-year, maturity, bonds, Treasury, yield, corporate, interest rate, interest, rate, and USA. Yield Earnings Equity Chart Bond Ratio The Bond Equity Earnings Yield Ratio (BEER) has two Sharpe Ratio Definition It may be a good bet for the long term 5 level it has averaged since 2003 99 per cent on October 1, while the one-year forward Nifty50 P/E was at 20 times, which indicates a BEER ratio of around 1 99 per cent on October 1, while the one-year forward Nifty50 P/E was at ...

SCHP Summary - schwab.wallst.com Duration is determined by a formula that includes coupon rates and bond maturities. Small coupons tend to increase duration, while shorter maturities and higher coupons shorten duration. The relationship between funds with different durations is straightforward: A fund with a duration of 10 years is twice as volatile as a fund with a five-year ...

what is the current market interest rate for bonds A coupon rate can best be described as the sum, or yield, paid on the face value of the bond annual over its lifetime. 15-year fixed-rate mortgages. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world.

10-Year T-Note Overview - CME Group Futures and Options. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading ...

Current Rates | Edward Jones All rates expressed as yield to maturity as of 7/8/2022 unless otherwise indicated. Yield and market value will fluctuate if sold prior to maturity, and the amount received from the sale of these securities may be less than the amount originally invested. ... There is a risk/reward relationship to every investment. Put simply, this means the ...

About Corporate Bonds - NSE - National Stock Exchange India Yield is commonly measured in two ways, current yield and yield to maturity. Current yield. The current yield is the annual return on the amount paid for a bond, regardless of its maturity. If you buy a bond at par, the current yield equals its stated interest rate. Thus, the current yield on a par-value bond paying 6% is 6%. Yield to maturity

WGU C214 Finance (Ch 1-15) - Flashcards - StudyHippo.com Inverse Price Relationship. answer. When interest rates drop, bond rates go up. When interest rates rise, bond rates go down. ... Coupon rate, time to maturity (primary factor). question. Primary financial instruments. answer. ... equal to the yield to maturity on a company's bonds multiplied by 1 minus the marginal tax rate.

Spread Curve Yield Search: Yield Curve Spread. Interest Rate Implication: Humped yield curves are very rare, but when they happen it means investors expect interest rates on medium-term, fixed-income securities to be higher than short- and long-term securities Properties This means the spread between the 30-yr and 5-yr yields is narrowing NEW YORK, November 10, 2020 - Qontigo, an investment intelligence leader ...

Vanguard Short-Term Corporate Bond ETF VCSH - Morningstar Additional credit risks come with some additional yield, as the fund's average yield-to-maturity tends to be higher than the category average. As of May 2022, this stood at 3.5% compared with 2.8% ...

Earnings Bond Equity Chart Ratio Yield This allows investors to compare, for example, 2 year investments in stocks with a bond's yield to maturity intrinsic value: a revisit The earning yield is quoted as a percentage, allowing a comparison to prevailing long-term bond rates (i Simply enter 4 of the 5 values for your bond then click the relevant button to calculate the missing value ...

Total Return Bond - Institutional Class - Guggenheim Investments Yield to maturity is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule.

Finance Archive | July 08, 2022 | Chegg.com Suppose a ten-year, $1,000 bond with an 8.4% coupon rate and semiannual coupons is trading for $1,034.38 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. I 1 answer Skippy wants to have $17,000.00 in 12 years. His bank is offering an account that earns 2% compounded monthly.

Bond Valuation - brainmass.com Yield to Call (YTC) and Yield to Maturity (YTM) of bonds Southern Bell has issued $1000 par, 43/8% coupon bonds that mature in 6 years. The coupons on these bonds are paid semiannually. These bonds are currently trading at a price of $853.75. The bonds are callable in 2 years at a call price of $1000. a.

Limited Duration - Institutional Class - Guggenheim Investments If there is no relationship between two variables, the correlation coefficient is 0. If there is a perfect relationship, the correlation is 1. And if there is a perfect inverse relationship, the correlation is -1. Duration is a measure of interest-rate sensitivity of a fixed-income security based on an interest rate change of 1% or 100 basis ...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.415% yield.. 10 Years vs 2 Years bond spread is 99.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

Post a Comment for "42 relationship between coupon rate and ytm"