39 find coupon rate of bond

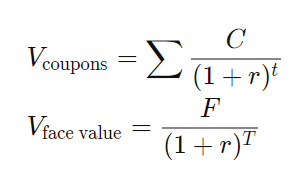

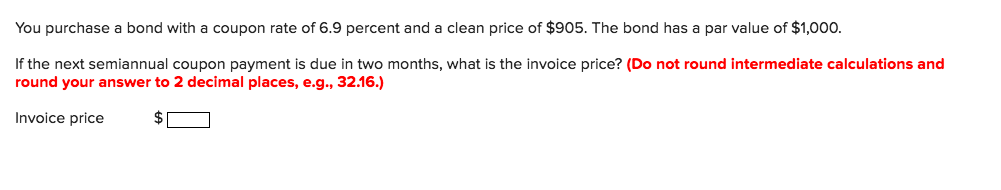

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Find coupon rate of bond

Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula: EOF › what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year ...

Find coupon rate of bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a ... What Is the Coupon Rate of a Bond? | SoFi The bond coupon rate formula is fairly simple and it looks like this: Bond coupon rate = Total annual coupon payment/Face or par value of the bond x 100. To apply the coupon rate formula you'd need to know the face or par value of the issued securities and the total interest payment. To find the annual coupon payment, you'd multiply the ...

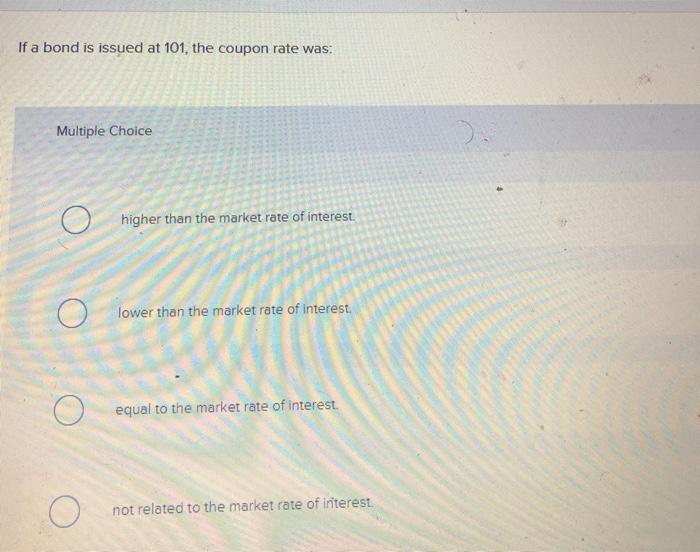

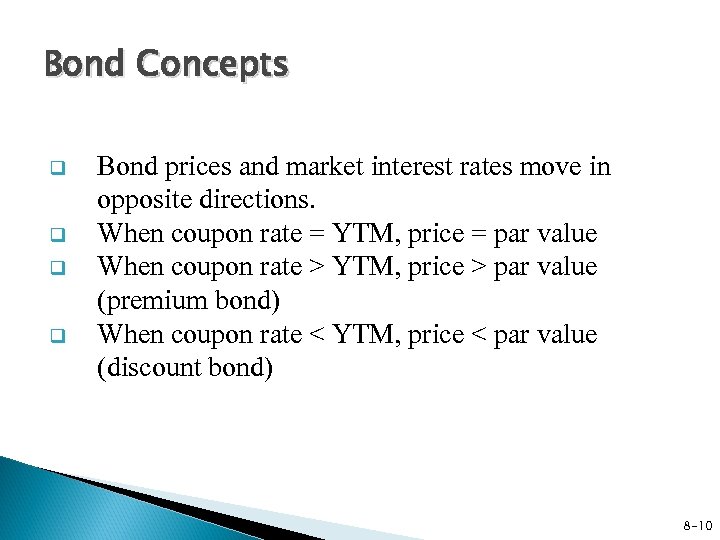

uk.financialadvisory.com › accounts › natwest-1-yearNatWest 1 Year Fixed Rate Bond - financialadvisory.com What are the requirements to open a UK NatWest Fixed Rate Bond: - According to the NatWest website, if you apply online you may be required to be required to be aged 18 years or over, permanently resident in the UK for tax purposes and have a NatWest account. Information to consider when opening an NatWest 1 Year Fixed Rate Bond: › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ... › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face ... What is a Coupon Rate? (with picture) - SmartCapitalMind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

Coupon Rate Formula & Calculation - Study.com Coupon Rate Formula. To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000.

www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. Average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am.

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year ...

EOF

Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula:

Post a Comment for "39 find coupon rate of bond"