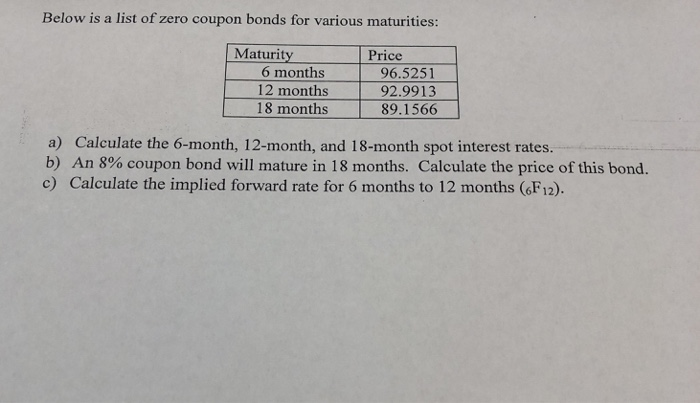

41 zero coupon bond price calculation

Answer (1 of 2): It is able to - alp.autohelp.fr For example, if a bond has a par value of $1,000 and a coupon rate of 8%, then you will receive annual coupon (interest) payments of $80 (1000 X .08 = $80) until the bond's maturity date. Most bonds make coupon payments semi-annually, so you would likely receive a $40 coupon payment two times each year. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

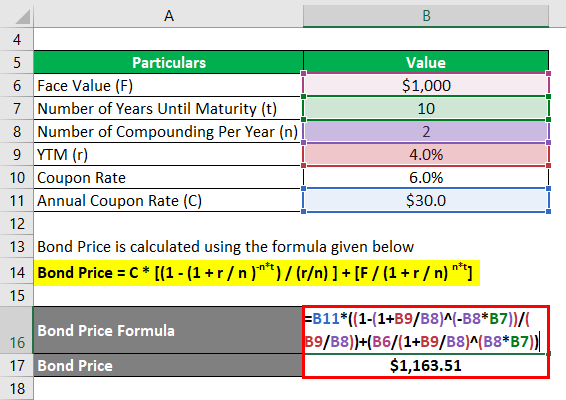

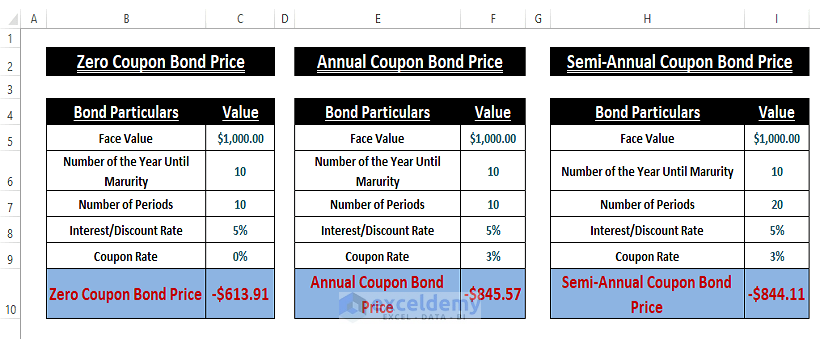

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Zero coupon bond price calculation

How to Calculate the Price of a Zero Coupon Bond Calculating Zero-Coupon Bond Price To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. Bond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Zero Coupon Bond Value Calculator | StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator.

Zero coupon bond price calculation. Zero Coupon Bond Value Calculator - Find Formula, Example & more Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. So, the original price of the share in question is Rs.747.26, which can then be redeemed at a face value of Rs.1000. What is the use of Zero Coupon Bond Value Calculator? Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. What is the difference between zero-coupon and traditional coupon bonds? How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

Zero-Coupon Bond Calculation - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate. How do I Calculate Zero Coupon Bond Yield? 18 Aug 2022 — Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the ... Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Bond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

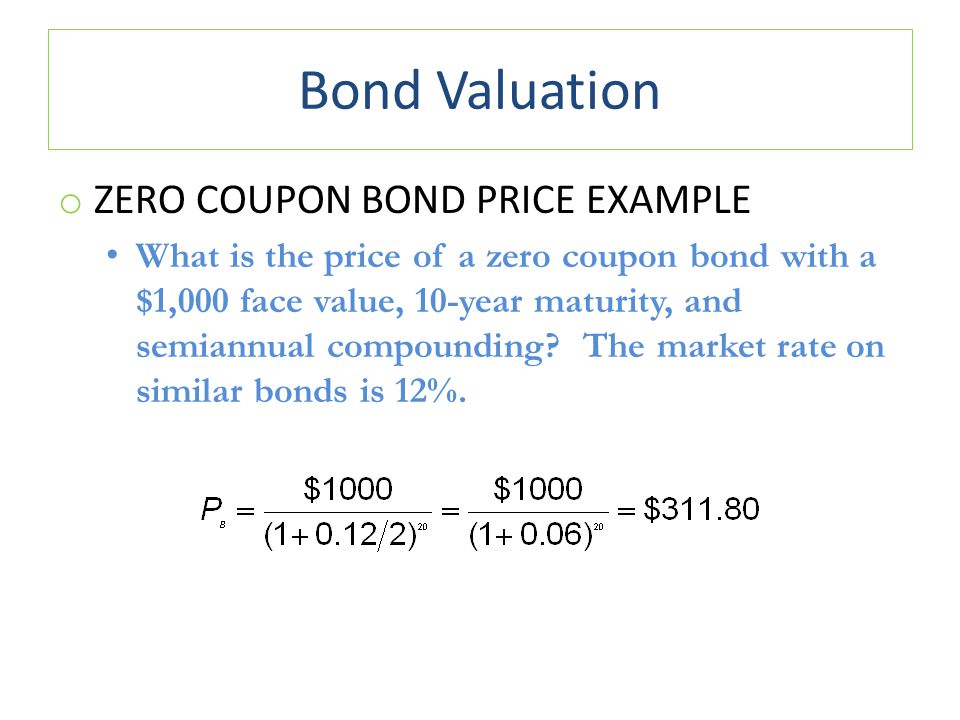

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond r = rate or yield t = time to maturity. Related. Bond Yield Calculator; Frequently Used Miniwebtools: Random Name Picker - Spin The Wheel to Pick The Winner .

Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

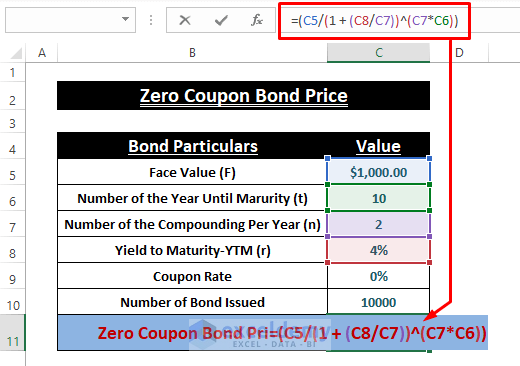

How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price.

Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. FAQ What is Zero Coupon Bond Value?

Zero Coupon Bond | Definition, Formula & Examples The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value ;

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

OID: What is an Original Issue Discount? - Wall Street Prep OID Bond Calculation Example. Suppose that a company decided to issue OID bonds with a stated redemption price of $1 million (“100”). If the issuance price was offered at a 2% discount to the redemption price, the bonds were offered for $980k (“98”). Issuance Price = $1 million × (1 – 2%) = $980k

Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator

Zero Coupon Bond Calculator - Calculator Academy The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero Coupon Yield Curve - The Thai Bond Market Association Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3. Spreads (bp) are differences bid and offer yields.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Value Calculator | StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator.

Bond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

How to Calculate the Price of a Zero Coupon Bond Calculating Zero-Coupon Bond Price To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

Post a Comment for "41 zero coupon bond price calculation"