40 government zero coupon bonds

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Government Bonds - Meaning, Types, Advantages Web10/11/2022 · Zero Coupon Bonds. As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue price and redemption value. In other words, these bonds are issued at a discount and redeemed at par. Further, these bonds are not issued through auction but created through existing …

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

Government zero coupon bonds

› the-basics-of-bondsThe Basics of Bonds - Investopedia Jul 31, 2022 · Some municipal bonds offer tax-free coupon income for investors. Government (sovereign) bonds such as those issued by the U.S. Treasury. Bonds (T-bonds) issued by the Treasury with a year or less ... Bond: Financial Meaning With Examples and How They Are Priced Web01/07/2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ...

Government zero coupon bonds. Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … WebIf rates fall longer duration zero-coupon bonds will increase in value significantly more than shorter duration federal government bonds & federal bonds which pay a regular coupon. If rates rise the converse is true - zero-coupon bonds will be hit much harder than other bonds. Negative Yields. After the financial crisis of 2008-2009 central banks became far … Zero Coupon Bonds (CTZs) - MEF Department of Treasury Remuneration is entirely determined by discount at issuance, which is equal to the difference between the nominal value and the price paid. Auctions are ... en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

Continued Treasury Zero Coupon Spot Rates - TreasuryDirect Interest Rates and Prices SLGS Daily Rate Table IRS Tax Credit Bond Rates ... Zero Coupon Spot Rates Average Interest Rates on U.S. Treasury Securities UTF ... Government bond - Wikipedia WebA government bond or sovereign bond is a debt obligation issued by a national government to support government spending.It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year … › country › united-statesUnited States Government Bonds - Yields Curve Nov 18, 2022 · United States Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Stripped government securities - Agence France Trésor Bond stripping separates coupon payments and bond principal redemption payments, thus creating the same number of zero-coupon bonds and a series of coupons.

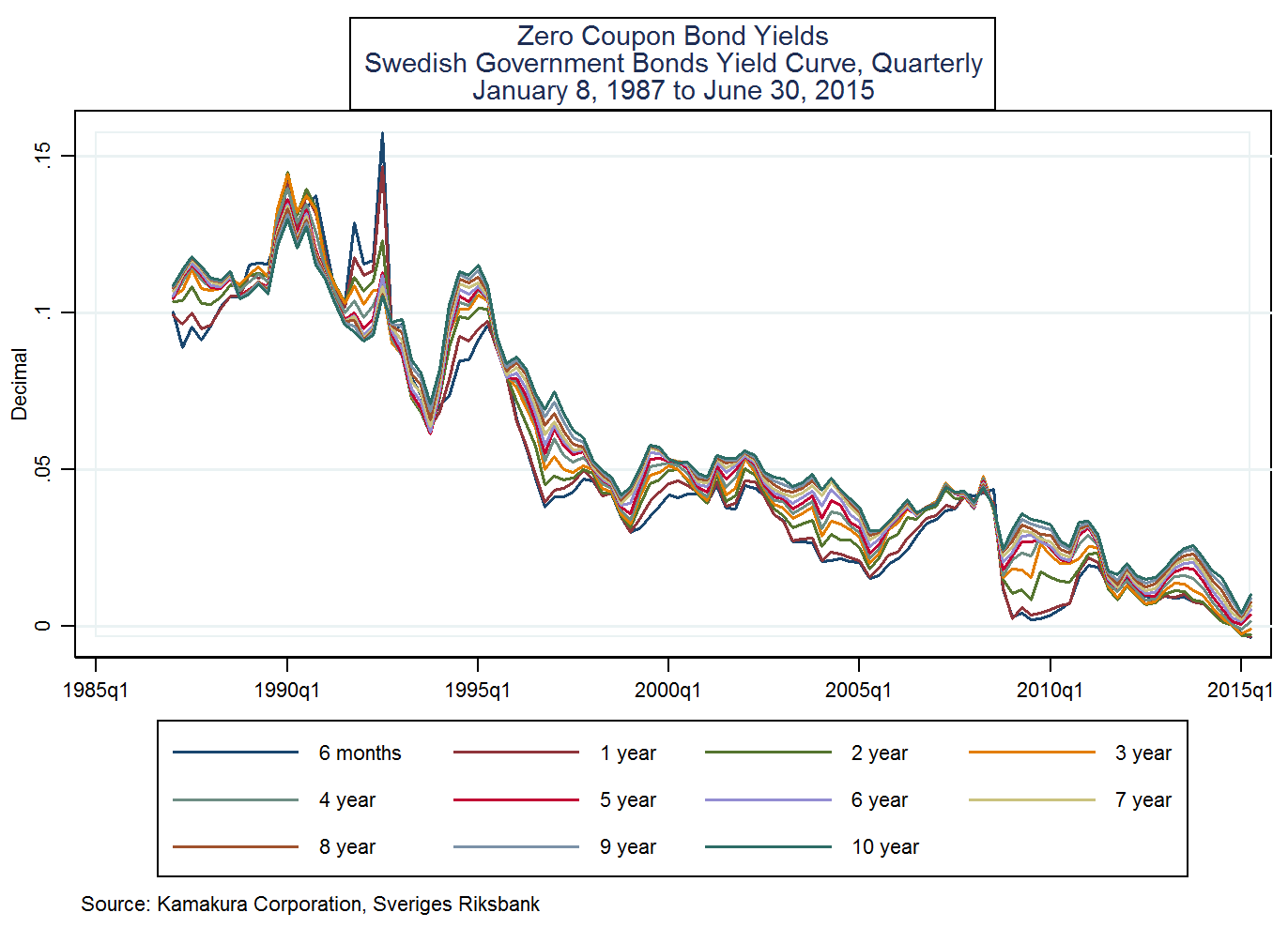

The Basics of Bonds - Investopedia Web31/07/2022 · Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular income taxes on the funds received. For this reason, bonds are best kept in a tax sheltered ... United States Government Bonds - Yields Curve Web18/11/2022 · The United States 10Y Government Bond has a 3.829% yield.. 10 Years vs 2 Years bond spread is -70.2 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.00% (last modification in November 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years … United States Rates & Bonds - Bloomberg WebGet updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. › markets › rates-bondsUnited States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year . 1.63: 100.22: 1.58%-6 +328: 4:59 PM:

Zero-Coupon Bond: Definition, How It Works, and How To Calculate Web31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. ... Unlike regular bonds, it ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest.

Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market …

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Treasury yield is the interest rate that the U.S. government pays to borrow money for different lengths of time. ... A zero-coupon bond is a debt security ...

scripbox.com › saving-schemes › government-bondsGovernment Bonds - Meaning, Types, Advantages & Disadvantages Nov 10, 2022 · Zero Coupon Bonds. As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue price and redemption value. In other words, these bonds are issued at a discount and redeemed at par. Further, these bonds are not issued through auction but created through existing securities.

Government Bonds: Types, Benefits & How to invest - BondsIndia WebZero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ...

Bond: Financial Meaning With Examples and How They Are Priced Web01/07/2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

› the-basics-of-bondsThe Basics of Bonds - Investopedia Jul 31, 2022 · Some municipal bonds offer tax-free coupon income for investors. Government (sovereign) bonds such as those issued by the U.S. Treasury. Bonds (T-bonds) issued by the Treasury with a year or less ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/14-Figure3-1.png)

Post a Comment for "40 government zero coupon bonds"