38 duration for zero coupon bond

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... U.S. News | Latest National News, Videos & Photos - ABC News - ABC News Nov 22, 2022 · The suspect is being held without bond on 10 "arrest only" charges. 11/23/2022 06:32:27 EST. Latest U.S. Video. 0:26 'Significant' fine sought for operator of Orlando FreeFall after teen's fatal fall.

How to Calculate Bond Duration - wikiHow Mar 29, 2019 · Bond duration is a measure of how bond prices are affected by changes in interest rates. This can help an investor understand a bond's potential interest rate risk. ... These "zero-coupon" bonds are sold at a deep discount to par when issued, but can be sold at their full par value when they mature. Advertisement. 3. Clarify coupon payment details.

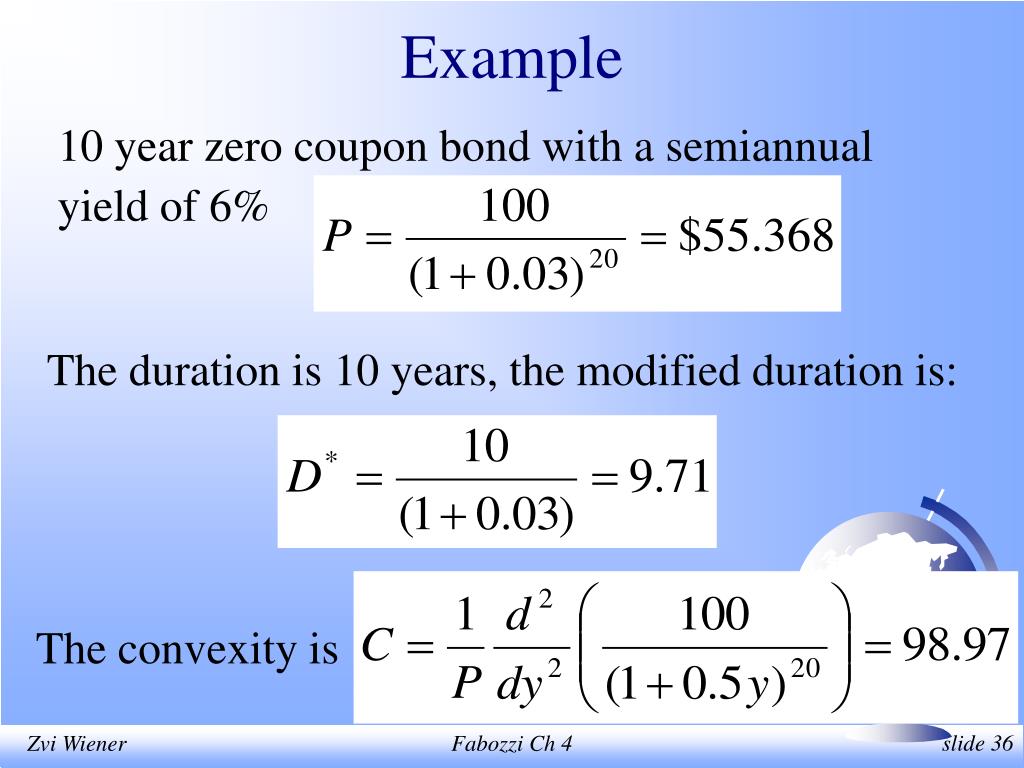

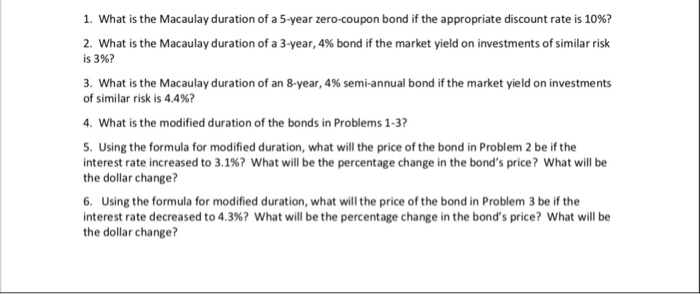

Duration for zero coupon bond

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. As the U.S. government used budget surpluses to pay down federal debt in the late … Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!) Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000 Coupon: 5% Current Trading Price: $960.27 Yield to Maturity: 6.5%

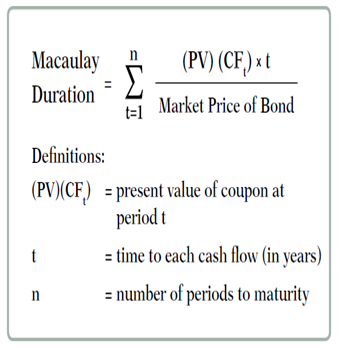

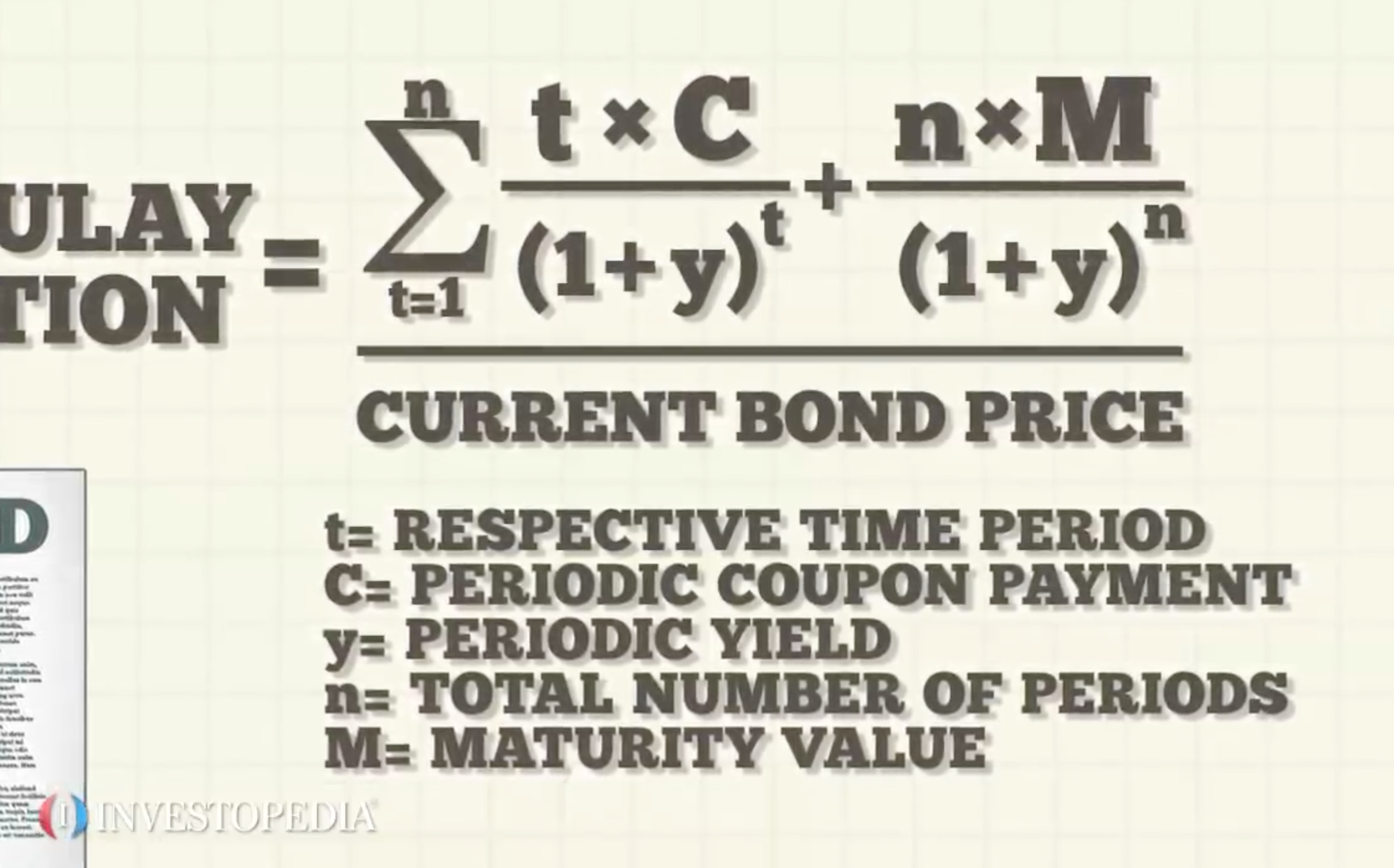

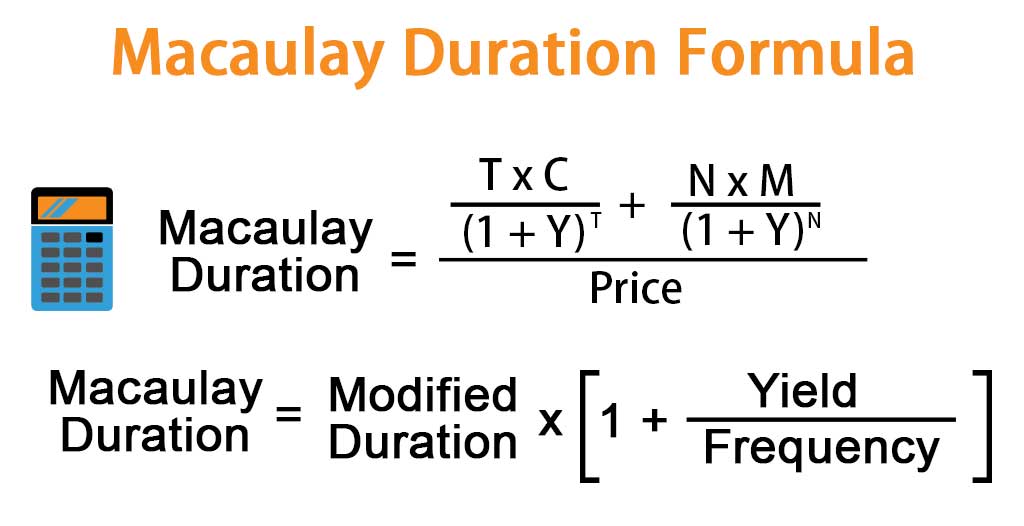

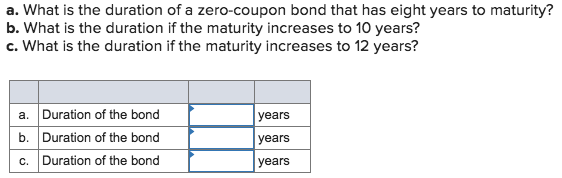

Duration for zero coupon bond. Understanding the Relationship Between Coupon Rates and Duration Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures. If I purchased a bond with a 6% coupon rate, duration would be significantly less than 30 years because I'm ... PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of Duration: Understanding the Relationship Between Bond … Duration is expressed in terms of years, but it is not the same thing as a bond's maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. What Is a Zero-Coupon Bond? - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as... Treasuries - WSJ Market Data Center on The Wall Street Journal. duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

The Basics of Bonds - Investopedia Jul 31, 2022 · Duration can be calculated on a single bond or for an entire portfolio of bonds. Bonds and Taxes Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Duration: The Time Bomb In Your Portfolio, McKesson And PayPal Oct 08, 2022 · In general, a bond with a very high coupon rate has a shorter duration than a bond with a lower coupon rate. A zero-coupon bond is therefore the riskiest way to invest in bonds from an interest ...

Duration and Zero Coupon Bonds - YouTube Examples of Macaulay duration are given for zero coupon bonds.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero-coupon bond - Wikipedia Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds may not reach maturity for decades, so it is essential to buy bonds from creditworthy entities. Some of them are issued with provisions that permit them to be paid out (...

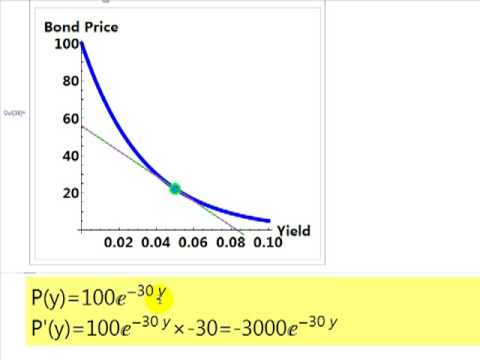

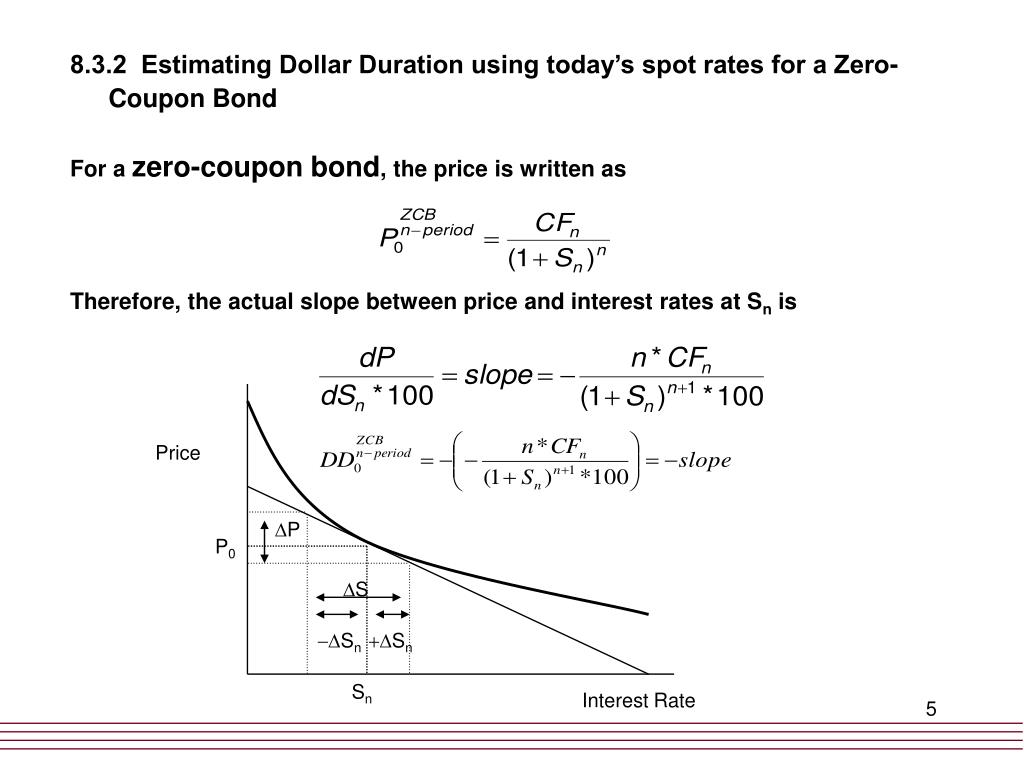

risk management - Calculate duration of zero coupon bond - Quantitative ... Let A and a be two constants and x be a variable. Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by. The book shows (duration of zero coupon bond): D z, T = − 1 P z ( t, T) [ d P z ( t, T) d r] Because I know the theory this makes total sense, but I cannot derive it.

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000 Coupon: 5% Current Trading Price: $960.27 Yield to Maturity: 6.5%

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!)

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. As the U.S. government used budget surpluses to pay down federal debt in the late …

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "38 duration for zero coupon bond"