44 what is the coupon rate of a bond

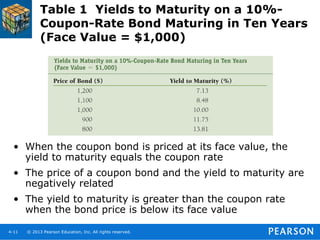

Coupon (finance) - Wikipedia WebIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 … Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or ...

Treasury Coupon Issues | U.S. Department of the Treasury WebNominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly …

What is the coupon rate of a bond

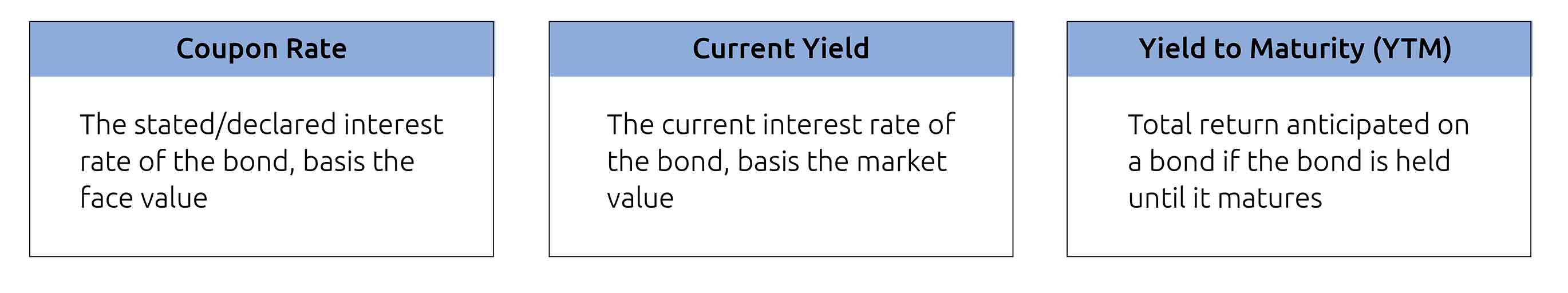

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia A discount rate is applied to calculate present value. For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price. Coupon Rate - Definition - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ...

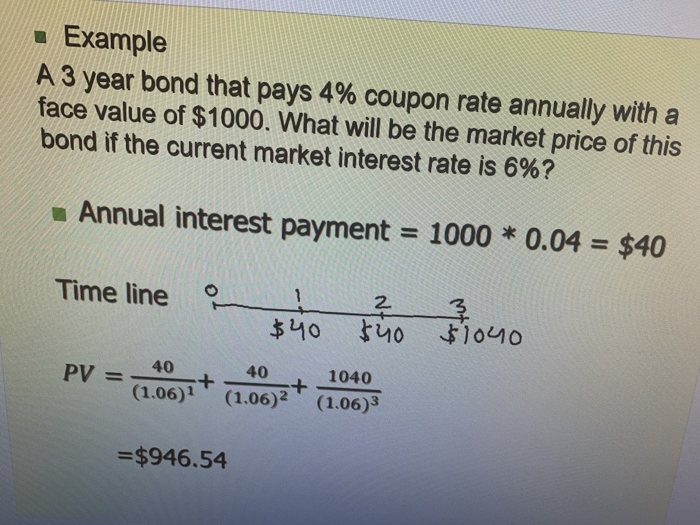

What is the coupon rate of a bond. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, ... Coupon Rate: Formula and Bond Calculation - Wall Street Prep The coupon rate, or nominal yield, is the rate of interest paid to a bondholder by the issuer. The pricing of the coupon on a bond issuance is used to calculate ...

Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market … What Is Coupon Rate and How Do You Calculate It? - SmartAsset WebTo calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. In our example ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Web22/03/2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders ...

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. › bond-prices-rates-yieldsBond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher percentage of its face value as interest. Price—The higher a bond or CD's price, the lower its yield. That's because an investor buying the bond or CD has to pay more for the same return. What Is the Coupon Rate of a Bond? - The Balance Web18/11/2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the ... Interest rate - Wikipedia WebFor an interest-bearing security, coupon rate is the ratio of the annual coupon amount ... Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all remaining cash flows to the investor (all remaining coupons and repayment of the par value at maturity) with the current market …

Bond Coupon Interest Rate: How It Affects Price - Investopedia Web18/12/2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebThe coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 ... A bond's coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the ...

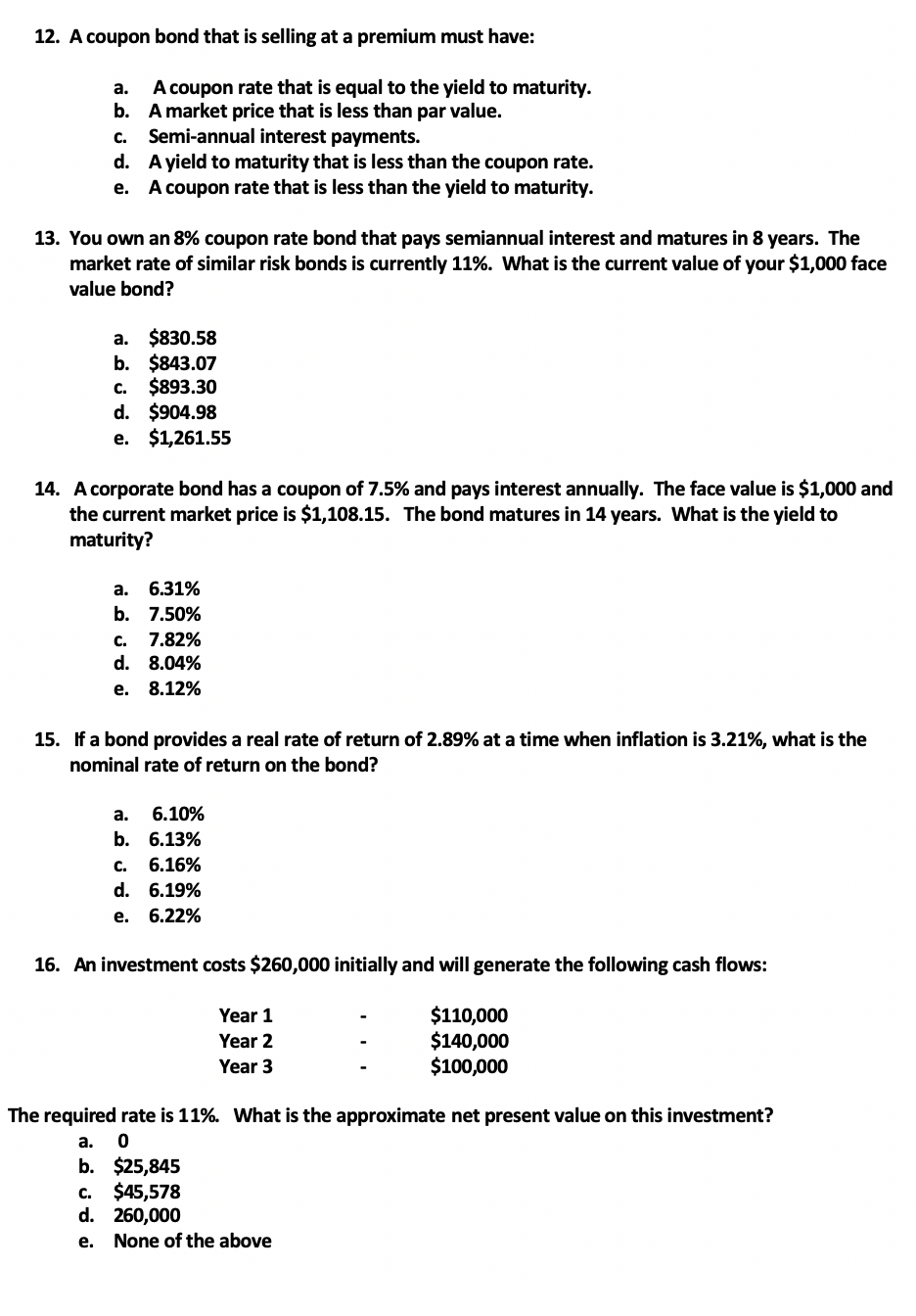

› terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate Definition - Investopedia Web28/05/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate - Definition - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ...

en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia A discount rate is applied to calculate present value. For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ...

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "44 what is the coupon rate of a bond"