44 how to determine coupon rate

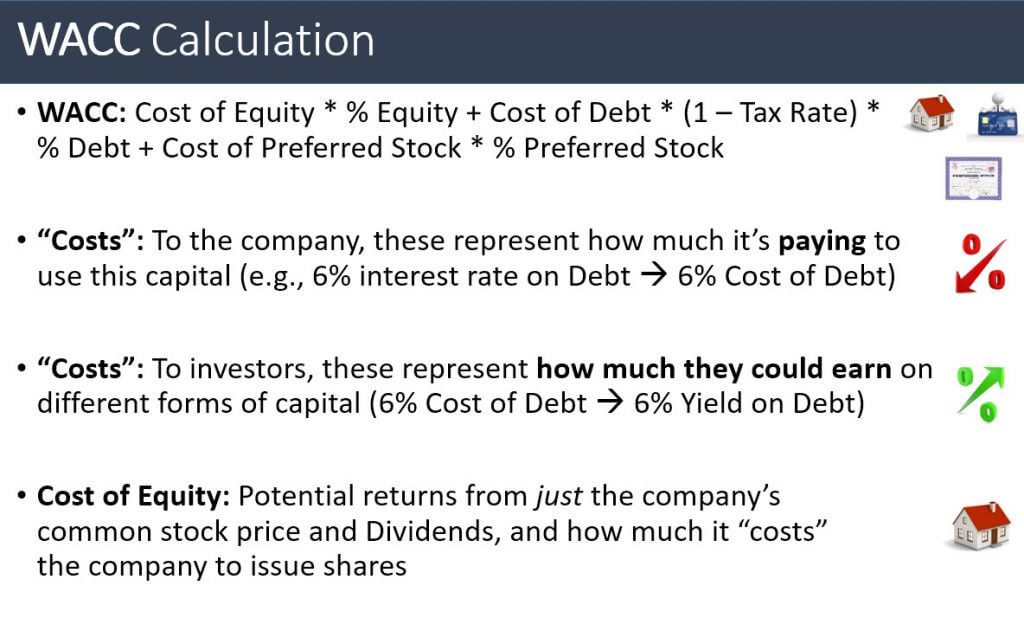

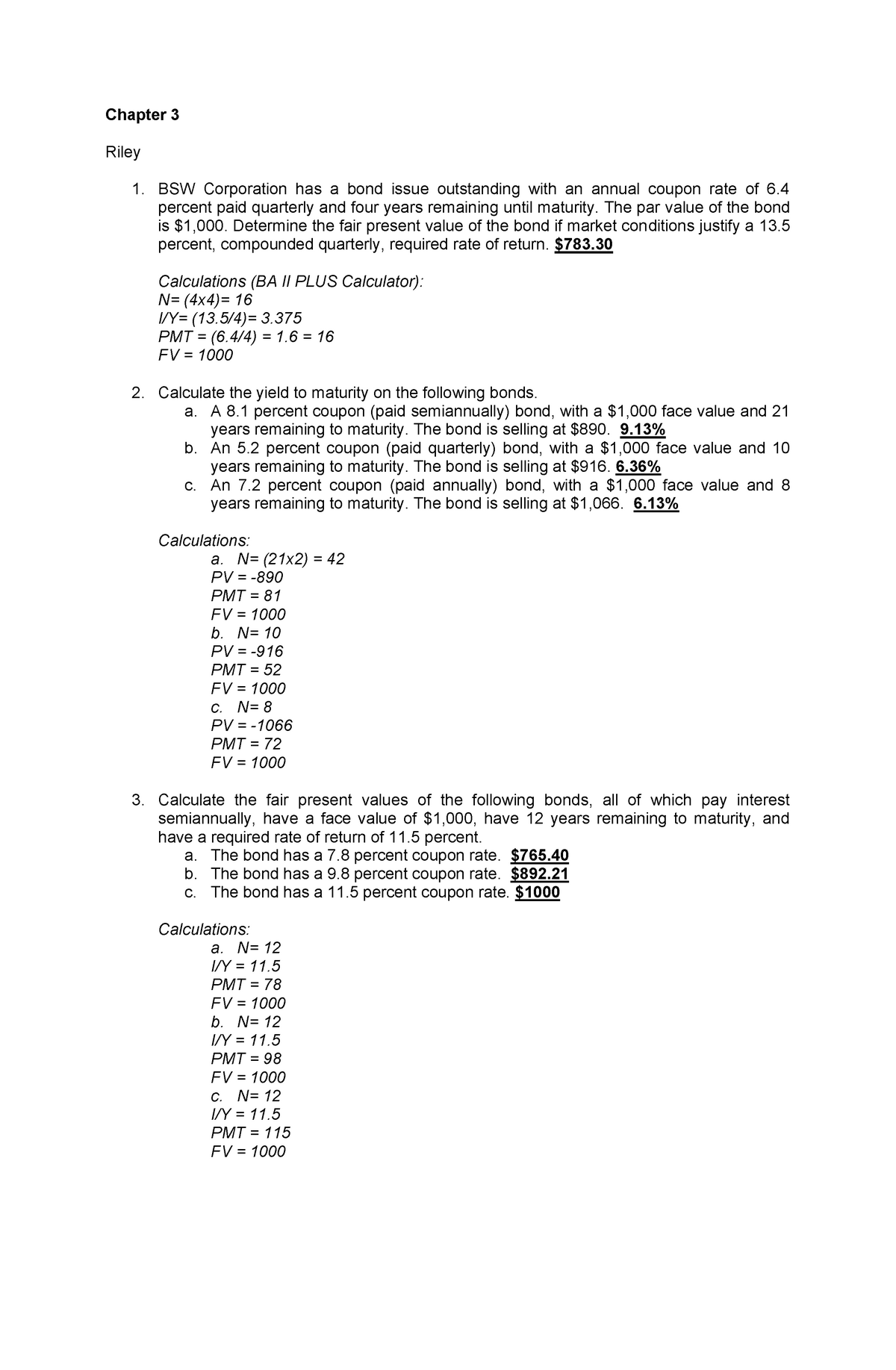

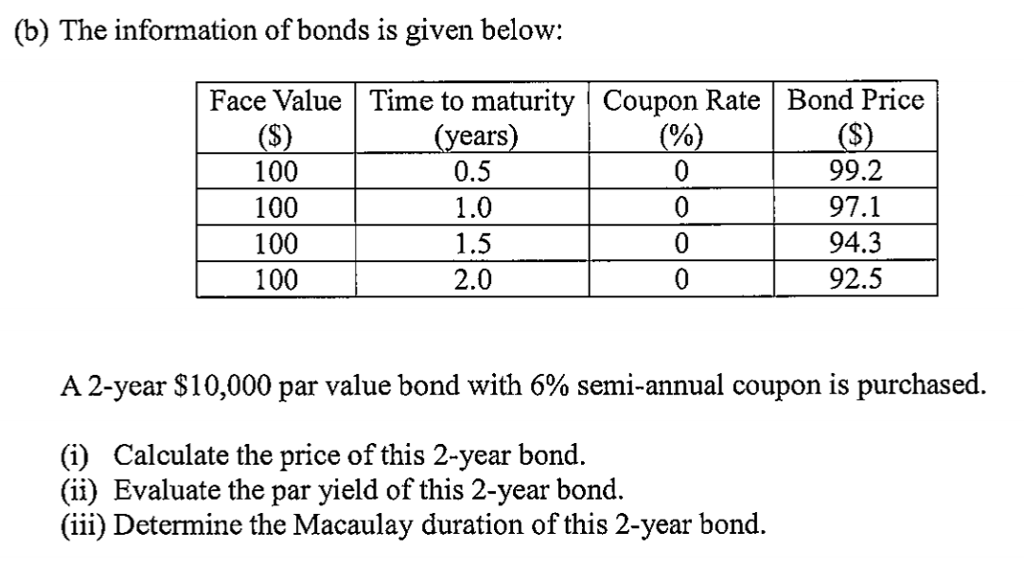

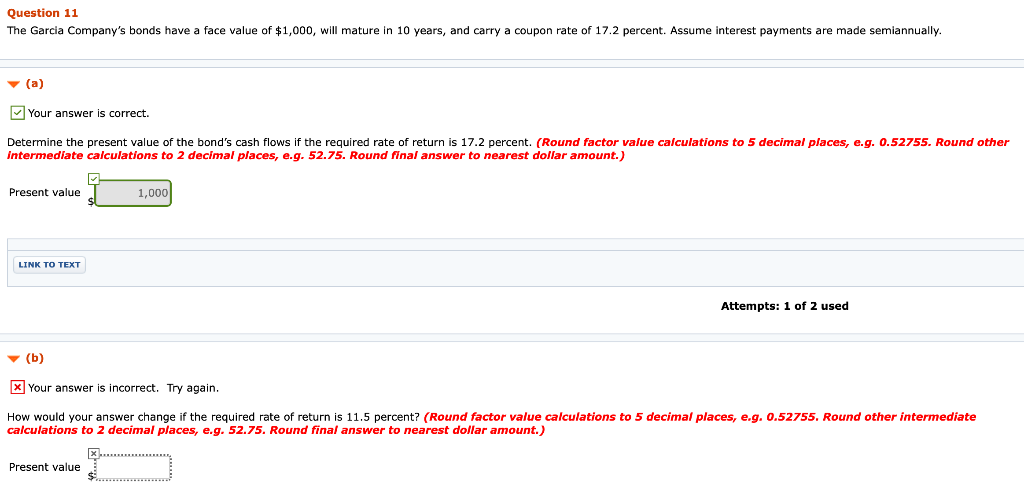

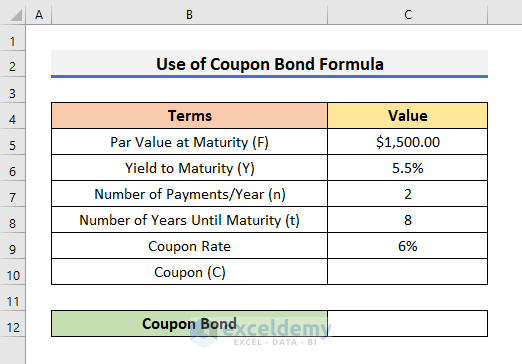

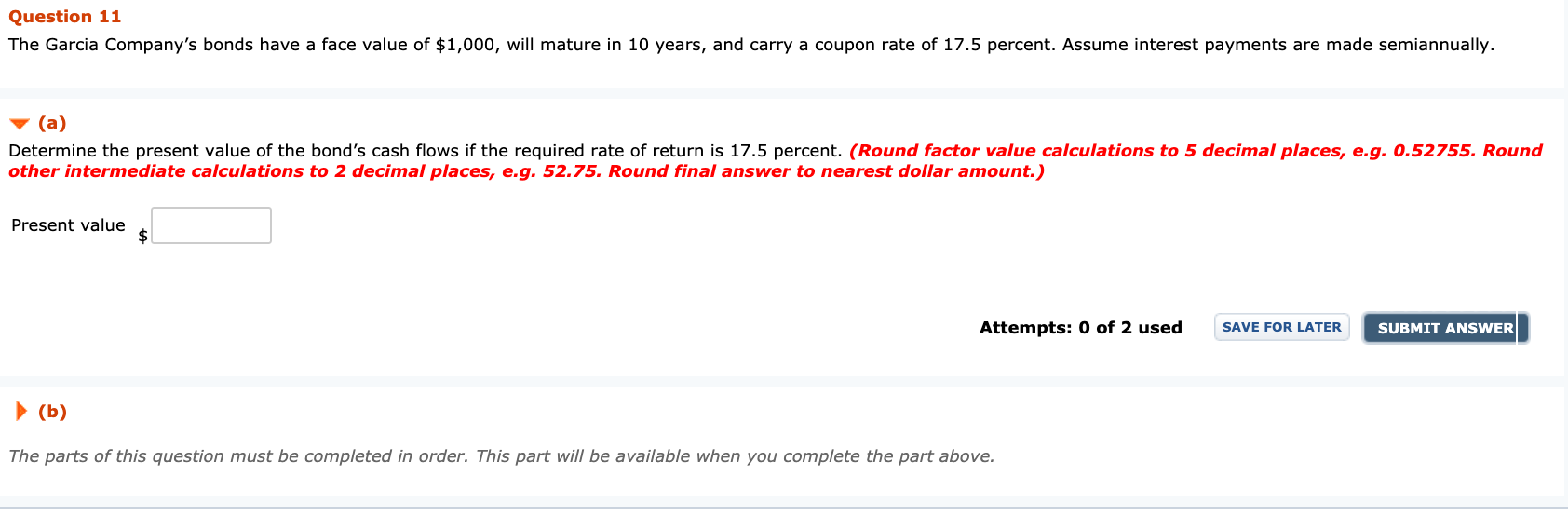

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond’s par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Rate: Formula and Bond Calculation (Step-by-Step) The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

How to determine coupon rate

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate of a bond is determined after considering various factors, but two of the key factors are interest rates of different fixed income security available in market at the time of issue of bond and creditworthiness of the company. The coupon rate of a bond is determined in a manner so that it remains competitive with other available fixed in... Coupon Rate Definition - Investopedia A coupon rate is the nominal yield paid by a fixed-income security. It is the annual coupon payments paid by the issuer relative to the bond's face or par value.

How to determine coupon rate. Coupon Rate Definition - Investopedia A coupon rate is the nominal yield paid by a fixed-income security. It is the annual coupon payments paid by the issuer relative to the bond's face or par value. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate of a bond is determined after considering various factors, but two of the key factors are interest rates of different fixed income security available in market at the time of issue of bond and creditworthiness of the company. The coupon rate of a bond is determined in a manner so that it remains competitive with other available fixed in...

Post a Comment for "44 how to determine coupon rate"